How G. Halsey Wickser, Loan Agent can Save You Time, Stress, and Money.

Table of ContentsThe smart Trick of G. Halsey Wickser, Loan Agent That Nobody is Talking AboutOur G. Halsey Wickser, Loan Agent StatementsG. Halsey Wickser, Loan Agent Things To Know Before You BuyG. Halsey Wickser, Loan Agent for Dummies8 Easy Facts About G. Halsey Wickser, Loan Agent Shown

The Assistance from a home mortgage broker does not finish as soon as your home loan is secured. They give recurring help, helping you with any type of concerns or concerns that develop throughout the life of your funding - mortgage lenders in california. This follow-up assistance makes sure that you remain satisfied with your home mortgage and can make enlightened choices if your economic situation changesSince they work with numerous lending institutions, brokers can locate a loan product that matches your one-of-a-kind financial situation, even if you have been denied by a bank. This adaptability can be the key to opening your desire for homeownership. Picking to deal with a home loan expert can transform your home-buying trip, making it smoother, much faster, and extra monetarily advantageous.

Locating the ideal home for on your own and determining your budget can be very difficult, time, and money-consuming - mortgage broker in california. It asks a great deal from you, depleting your energy as this job can be a task. (https://jobs.employabilitydallas.org/employers/3338556-g-halsey-wickser-loan-agent) A person that functions as an intermediary between a borrower a person looking for a mortgage or home car loan and a lender usually a financial institution or credit score union

G. Halsey Wickser, Loan Agent for Beginners

Their high degree of experience to the table, which can be important in aiding you make informed decisions and inevitably attain successful home financing. With rate of interest changing and the ever-evolving market, having somebody totally tuned in to its ongoings would make your mortgage-seeking process much simpler, relieving you from navigating the struggles of loading out documents and executing heaps of research study.

This lets them use professional advice on the finest time to secure a home loan. Due to their experience, they also have established connections with a large network of lenders, ranging from major financial institutions to customized home mortgage providers.

With their sector understanding and ability to discuss properly, home mortgage brokers play a critical role in safeguarding the very best home mortgage offers for their clients. By keeping partnerships with a diverse network of loan providers, home mortgage brokers acquire accessibility to numerous mortgage options. Furthermore, their enhanced experience, described above, can offer invaluable information.

Excitement About G. Halsey Wickser, Loan Agent

They possess the abilities and techniques to convince loan providers to give far better terms. This may include reduced rates of interest, minimized closing expenses, or also a lot more flexible repayment schedules (mortgage lenders in california). A well-prepared home loan broker can present your application and monetary account in a means that allures to lenders, raising your opportunities of an effective negotiation

This advantage is frequently a positive shock for several property buyers, as it enables them to leverage the expertise and resources of a home loan broker without stressing over incurring additional costs. When a debtor safeguards a home mortgage with a broker, the lender compensates the broker with a compensation. This commission is a portion of the lending amount and is usually based on factors such as the rate of interest and the kind of car loan.

Home loan brokers stand out in recognizing these distinctions and dealing with lenders to find a home loan that fits each debtor's specific demands. This individualized technique can make all the difference in your home-buying journey. By working very closely with you, your mortgage broker can make sure that your financing terms and problems align with your financial objectives and capacities.

A Biased View of G. Halsey Wickser, Loan Agent

Tailored mortgage solutions are the secret to a successful and sustainable homeownership experience, and home loan brokers are the professionals that can make it happen. Hiring a mortgage broker to work alongside you may lead to fast funding approvals. By utilizing their proficiency in this area, brokers can help you avoid prospective pitfalls that usually cause delays in finance approval, causing a quicker and much more reliable path to safeguarding your home financing.

When it pertains to buying a home, navigating the globe of home mortgages can be frustrating. With a lot of choices offered, it can be testing to discover the best loan for your demands. This is where a can be a useful source. Mortgage brokers act as middlemans in between you and potential lenders, helping you discover the very best mortgage deal customized to your certain scenario.

Brokers are fluent in the ins and outs of the mortgage market and can offer important understandings that can assist you make notified decisions. Rather of being restricted to the mortgage products offered by a single lending institution, mortgage brokers have accessibility to a wide network of loan providers. This means they can search in your place to find the finest financing choices offered, potentially saving you time and cash.

This accessibility to several lenders offers you an affordable benefit when it comes to safeguarding a desirable home loan. Searching for the right home mortgage can be a taxing procedure. By dealing with a home mortgage broker, you can save effort and time by allowing them manage the research and paperwork associated with finding and safeguarding a loan.

Facts About G. Halsey Wickser, Loan Agent Uncovered

Unlike a small business loan policeman who might be handling numerous clients, a mortgage broker can offer you with personalized service tailored to your individual requirements. They can put in the time to understand your monetary circumstance and objectives, providing tailored services that line up with your particular demands. Home mortgage brokers are knowledgeable arbitrators who can aid you protect the very best possible terms on your finance.

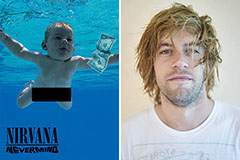

Spencer Elden Then & Now!

Spencer Elden Then & Now! Michelle Pfeiffer Then & Now!

Michelle Pfeiffer Then & Now! Barry Watson Then & Now!

Barry Watson Then & Now! Heather Locklear Then & Now!

Heather Locklear Then & Now! Terry Farrell Then & Now!

Terry Farrell Then & Now!